Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Real Estate and Covid-19 Part 4

How Covid-19 has Changed the Experience of Buying Real Estate

By Erin Wright and Christina Waterhouse

Over the last three weeks, we have explored the economic impacts of Covid-19 on our local Real Estate Market. These next two weeks we will be focusing on the challenges that are currently being faced by buyers and sellers transacting real estate and how our local market has responded to those challenges to make the process safer and easier.

The Buyer Process During Covid-19

Implementing the Governor’s Rules

Buying a house in the current pandemic has proven to be a bit challenging. There are some new practices we are seeing to help keep everything organized and try to keep people safe. We will start by reviewing what is required by the Governor of Washington State for Clark County. Currently there are two rules in place, no more than two people can be inside of a house at a time during a showing. Also, people must maintain six feet between them for social distancing. This means that buyers can only enter a house one at a time with a Realtor. This can be difficult because families, couples, friends, or investors cannot be in the house at the same time discussing their thoughts on it. We have found it helpful to take Buyers in one at a time while maintaining the 6 feet for a buffer, and then reconvene in the street in front of the house to discuss the property while it is still fresh in everyone’s mind. The sooner all buyers can discuss the property together the better to ensure that nothing is lost. This process does increase the time it takes to view properties. We plan on showings taking about twice as long because each person is shown individually and then we discuss at the end instead of while actually going through the property.

Virtually Viewing a Neighborhood and House

Researching a neighborhood online before doing a drive by is a great way to learn more while sheltering in place.

Prior to actually viewing a property in person, there are many things a buyer should plan on doing before ever having the agent schedule the showing. First, a buyer should become very familiar with a desired neighborhood. This can be done by discussing the neighborhood with a Realtor. Ask about the schools, amenities, and house styles to start. A Realtor can also send you links to local publications, neighborhood data, and school sites . It is also a good idea to take a drive through the neighborhood and see what it is like in person.

Once the desired neighborhoods have been pinpointed, take advantage of all of the online tools to view specific properties. When looking at houses online, switch the map function to show an aerial view of the property. Look for both pros and cons of the property’s location. Are there parks nearby? Power lines? Is it on a busy road or to close to a large freeway? Once the properties with desirable locations are found, thoroughly look at the photos of the property. Pay attention to the sizes of rooms by using the furniture in the photos as a gauge. Also, pay attention to how the house flows, again furniture can be used to help identify how the photos are moving through the house. When available, look at the online floor plan and virtual tour. Combined, these tools help Buyers understand the property better to see if it is a fit for what they are looking for.

Hand sanitizer, shoe covers, and face masks are both common things to expect while viewing properties during Covid-19.

What to Expect During Showings

With a narrowed down list of approved properties, buyers should call their Realtors to set up showings. We already discussed the rules of showings above based on the Governor’s guidelines. However, there are additional things buyers should expect during this time. First and foremost, get pre-approved. Almost all sellers are requiring pre-approved buyers only to view properties. Once pre-approved send the letter to your Realtor, they may be required to submit it prior to a showing. Additionally, some sellers are having buyers and their Realtors submit a basic health questionnaire prior to a showing. With the showing scheduled and all necessary information submitted, be prepared to take a few extra steps to keep things sanitary. Sellers are requiring a variety of things for people going into their homes: masks, sanitation wipes, gloves, hand sanitizer, and shoe covers to name a few. Most items requested to be used will be provided at the house itself. If they are not provided at the house and you do not have access to them, request them from your Realtor. If the request is made in advance, it can often be accommodated.

When you first enter the market, this may all seem a bit alarming. However, we have seen several companies, agents, and sellers really step up to keep everyone safe and make everyone feel comfortable. For more information on how to stay safe and what to expect as a buyer in this market, please feel free to comment on this blog post or reach out to us directly.

As always, we welcome any questions you may have and are happy to offer advice.

Real Estate and Covid–19 Part 2

Understanding Why Interest Rates Impact Buyer Activity in the Market

By Erin Wright and Christina Waterhouse

Last week we reviewed the overall Real Estate Market in Clark County since the start of the pandemic. This week we are looking deeper into why interest rates are impacting buyer activity.

Interest Rates, Buying Power, & Inventory

Home buyers have seen historically low interest rates since the end of the Great Recession, between 3% and 5% roughly, compared to the average mortgage interest rate over the last 50 years of 7.91%.[1]

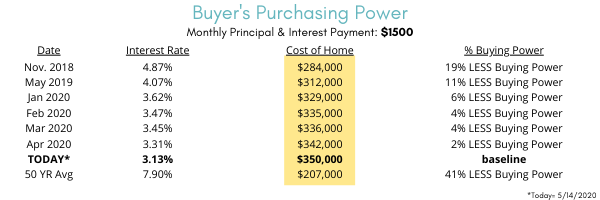

Since the start of the current pandemic, interest rates have continued to lower. The rate as of today (Thursday, May 14, 2020) is 3.13%.[2] In the chart below, you see that even the small changes in interest rates from about 18 months ago until today make a big impact on buying power. This is crucial because in a market like Clark County where there is a housing crisis due to the rapidly rising cost of real estate, more buying power opens up more inventory. Just since the start of 2020, Buyers looking for a $1,500 payment a month for principal and interest (not including taxes and insurance) saw their borrowing power increase from $329,000 to $350,000. To showcase how this impacts their choices, we ran a search on Redfin for a detached, single family home in Clark County. There are currently 28 houses listed for sale up to the price of $325,000. When we move that budget up to $350,000, there are 80 houses listed for sale. Just that $25,000 increase in budget, returned 3x the inventory on the market.

Interest Rates and Monthly Payments

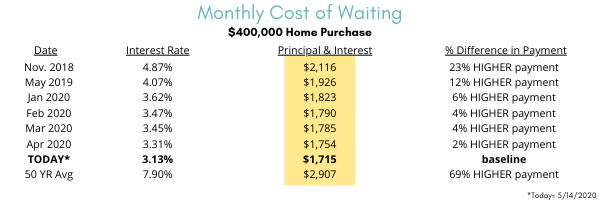

Let’s also look at how the interest rate impacts a monthly payment and therefore a buyer’s monthly budget. In the chart below, you can see how the interest rate would impact a monthly payment for principal and interest (not including taxes and insurance) if a buyer purchased a house at an interest rate from 18 months ago, the beginning of this year, and today. There is a 23% difference in the monthly payment from the most recent high interest rate in November 2018 vs the interest rates today. For a $400,000 house, that equates to an extra $400 a month. This is important because even though some buyers are qualified to purchase a house, they do not feel comfortable spending more than a certain amount per month on their housing. With the interest rate saving $100’s of dollars a month, new buyers will be able to feel comfortable entering the market.

With Buyers able to enter the marketplace and have more buying power since the start of the pandemic, there is still a demand to purchase real estate. As we discussed last week, this demand mixed with fewer new listings coming on the market that would typically be seen this time of year has led to a strong Sellers’ market. The current demand mixed with the lower supply has kept prices stable even during a pandemic with high unemployment.

Mortgage insight and references provided by: Mathew Mattila, Cascade Northern Mortgage: https://www.mathewmattila.com/

As always, we welcome any questions you may have and are happy to offer advice.

[1] History of Monthly Interest Rates According to Freddie Mac: http://www.freddiemac.com/pmms/pmms30.html

[2] Daily Interest Rates According to Mortgage News Daily: http://www.mortgagenewsdaily.com/data/30-year-mortgage-rates.aspx

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link